The simple way to access more of your pay

Salary packaging with Maxxia can unlock your pre-tax salary and could help you save

What types of expenses could you salary package?

Put your money to work by salary packaging a wide range of expenses, including:

- Self-education, conferences and seminars including travel costs

- Professional memberships

- Work-related devices

- Additional superannuation contributions1

Novated Leasing

Also known as salary packaging a car. Drive the car of your dreams and you could reduce your taxable income.

The simple way to maximise your pay

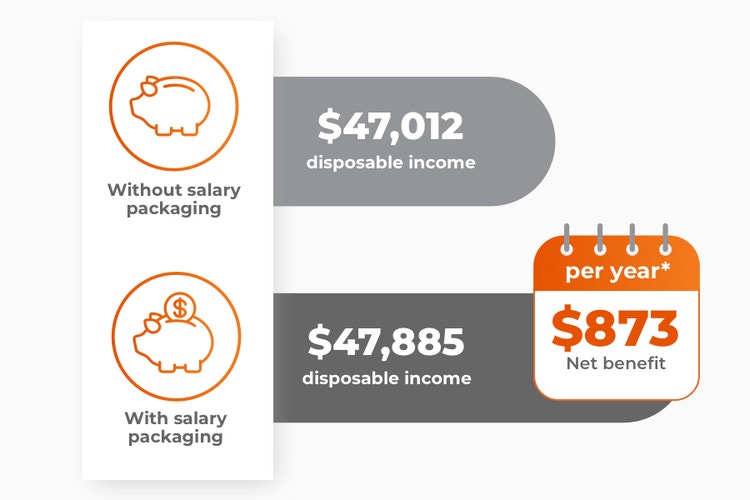

Let’s take this example of an employee who earns $60,000 annually. By salary packaging $3,000 of their pre-tax salary towards additional superannuation contributions1- they are potentially saving $873 in tax per year!

*Estimate only. Individual circumstances may vary.

Calculate Your Savings

Use our handy salary packaging calculator to see how much you could save!

Getting started

It only takes a few minutes to get started and take advantage of salary packaging benefits at your workplace.

Follow these three steps to sign up.

1. Click on the link below.

2. Fill out the form with your details

We’ll need to know your employer and other additional information to check your eligibility.

3. Request a callback

Nominate a time that suits you for one of our consultants to give you a call to complete your set up.

Salary Packaging: The estimated potential tax benefit is based on the assumption that the disposable income is based on an eligible employee with an annual salary of $60,000 salary packaging to a $3,000 per annum. PAYG tax effective 1 July 2024 have been used. An average salary packaging administration fee has been used. The actual administration fee that applies to you may vary depending on your employer. Your disposable income will vary based on your income and personal circumstances.

1The Meal Entertainment benefit has a maximum annual cap limit of $2,650. This will appear as a reportable fringe benefit on your Payment Summary each year which will be included in a number of income tests relating to certain government benefits and obligations. This cap is separate from the FBT cap limits for everyday living expenses. The Meal Entertainment benefit does not cover take-away meals, groceries or eating out on your own.

2Additional superannuation contributions from pre-tax salary are subject to 15% contributions tax. The taxation of additional superannuation contributions via salary packaging may differ from the taxation of additional superannuation contributions from post-tax salary. Additional superannuation contributions will be reported on an employee’s annual payment summary and will be used to assess an employee’s eligibility for a number of government benefits, or liability for certain payments. Caps for concessional superannuation contributions apply – please refer to www.ato.gov.au for up to date information. Only one laptop and one iPad or tablet can be salary packaged per FBT year and must be used primarily for business purposes.

Important Information: This general information doesn’t take your personal circumstances into account. Please consider whether this information is right for you before making a decision and seek professional independent tax or financial advice. Conditions and fees apply, along with credit assessment criteria for lease and load products. The availability of benefits is subject to your employer’s approval. Maxxia may receive commissions in connection with its services.

Maxxia Pty Ltd | ABN 39 082 449 036