Salary Packaging

Why pay more tax than you have to?

How does salary packaging work?

You may have heard people talking about salary packaging, but what is it? How does it work? And if you could pay less tax by doing it, why wouldn’t you?

Salary packaging – or salary sacrificing as it's often known – is an exciting story, but it can also seem complicated at first. At Maxxia, we’ve been helping Australians understand salary packaging for more than 30 years, so let’s see if we can simplify it.

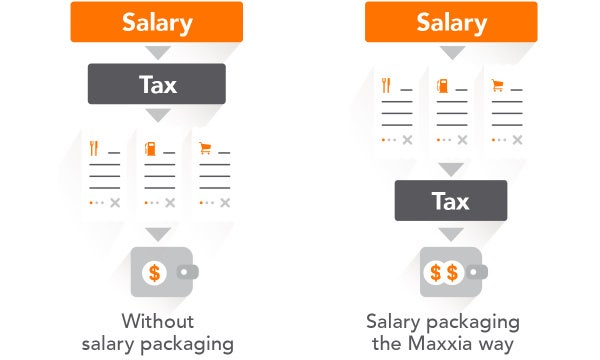

Ordinarily, your employer takes out income tax from your pay and deposits the remainder into your bank account. You then pay all your living expenses – including your rent or mortgage, car repayments, insurances, groceries and utility bills – and if you’re lucky, have a bit left over.

But with a Maxxia salary packaging account, your employer still pays you the same salary, but we help you pay those same expenses before tax is taken out.

This means your taxable income could go down, your disposable income could go up, and with some of these expenses already taken care of, you could have more money for other essentials and surprises.

It’s no surprise that thousands of Australians currently enjoy the benefits of salary packaging with Maxxia.

Make everyday living expenses work for you

An example. Let’s say Susie earns $60,000. She works for a charitable organisation, and her employer provides a program which allows her to salary package a range of expenses (discover more information on what you could package in our “What can I package section” below) up to a cap of $15,900 each FBT year.

By packaging to her full cap of $15,900 she could enjoy tax savings up to $4,857* each FBT year.

This amount doesn’t include other salary packaging benefits she could be entitled to, including Meal Entertainment (up to $2,650 each year) and salary packaging a car through a novated lease.

Please note that Susie’s ability to salary sacrifice is dependent on the industry she works in and her employer’s policy. Contact us to discuss the amount you may be able to salary sacrifice, given your individual circumstances.

If watching a video could help you pay less tax, why wouldn't you?

The types of benefits and the amount you can package depends on your employer and industry you work in. We’ve created some helpful videos covering all the benefits that could be available by industry.

Salary packaging has many benefits, salary packaging with Maxxia has many more

What can I package?

The benefits available and the amount you may be eligible to package depends on your employer and industry. Select your industry group below.

Healthcare & Charity

Includes public and private not-for-profit health, private health and charitable organisations.

Corporate & Government

Includes public education, private companies and government agencies.

Rebatable & Others

Includes private schools, clubs, associations or religious institutions.

Let’s Get Started

FAQs

How will salary packaging affect my pay?

Here’s what happens once you've set up a Maxxia salary packaging account:

- each pay cycle, your employer's payroll department deducts a nominated portion of your salary before tax is applied – and sends those funds to us

- you can then use these funds to pay for your chosen benefits (e.g. Living expenses, Mortgage payments)

- the rest of your salary gets taxed. However, because some of your salary has been taken out (to pay for your chosen expenses), you may be taxed on a lower amount

- your post-tax salary is then deposited into your bank account as usual.

By getting taxed on a lower amount and effectively paying less tax, your disposable income could be increased. This could leave you with more to spend at each pay cycle.

Is salary packaging difficult to manage?

No, we take care of the hassles so enjoy the benefits. After we set up your salary packaging arrangements, we also manage them for you. This means that we pay for your nominated expenses on your behalf – using your pre-tax dollars. No more juggling bills and due dates!

In exchange for managing your salary packaging account, we charge an administration fee that is dependent on the benefit and agreed upon with your employer. All fees are paid out of your pre-tax dollars and don’t contribute to your salary packaging cap limit or attract FBT.

My Maxxia app and online

While we pay for your expenses on your behalf, it’s important you know what's being paid and how much is in your salary packaging account at any time. The My Maxxia is accessible 24/7 and allow you to:

- view your transactions

- view your account balance

- change your details

- submit reimbursement claims

Important Information

This general information doesn’t take your personal circumstances into account. Please consider whether this information is right for you before making a decision and seek professional independent tax or financial advice. Conditions and fees apply, along with credit assessment criteria for lease and loan products. The availability of benefits is subject to your employer’s approval. Maxxia may receive commissions in connection with its services.

*Salary packaging example: The estimated potential tax benefit is based on the assumption that an eligible employee salary packages the full $15,900 per annum limit. FBT rates effective 1 July 2024 and PAYG tax rates effective 1 July 2024 have been used. The actual administration fee that applies to you may vary depending on your employer. Tax, benefit, and Medicare levy calculations are approximate and assume no other taxable income is received. HELP repayments and taxation surcharges are excluded.