EOFY. RUN IN. DRIVE OUT.

Offer ends 6 June 2025**

The EOFY sale with year round tax saving potential.

Offer applies to eligible new and demonstrator BMW iX1, iX2 and i4 eDrive35 vehicles made available through novated lease arrangements

Offer applies to eligible new and demonstrator BMW iX1, iX2 and i4 eDrive35 vehicles made available through novated lease arrangements

The BMW i4 is a sleek, mid-sized sedan and deliverer of outstanding dynamics, comfort, safety and performance. Combining sportiness and elegance with state-of-the art technology.

A dynamic blend of innovation, luxury, versatility and modern functionality, this all-electric BMW is typically impressive. The exterior is sporty, while high-quality materials headline the interior.

The BMW fully electric iX1 boasts impressive European design with an exception standard. Despite its EV power and technology, the iX1 still offers traditional BMW interior comforts.

features 5 Door SUV, 400 km Range, 230kW Electric Motor, Four Wheel Drive and 5 Star ANCAP Safety Rating

Love a discount just for driving a brand new EV? The Federal Government’s Electric Car (EV) Discount means all the EVs payments come from before tax salary.

It could add up to saving thousands in tax on any eligible EV that retails up to the Luxury Car Tax threshold of $91,387*. How does it actually work? Since 100% of your EV payments with a novated lease are taken out of your income before tax, your taxable income is lower. This could mean lower income tax payable, leaving more money for you.

And, it means the weekly price on a novated lease could be the same for either a new eligible EV, or a petrol car that’s worth thousands less.

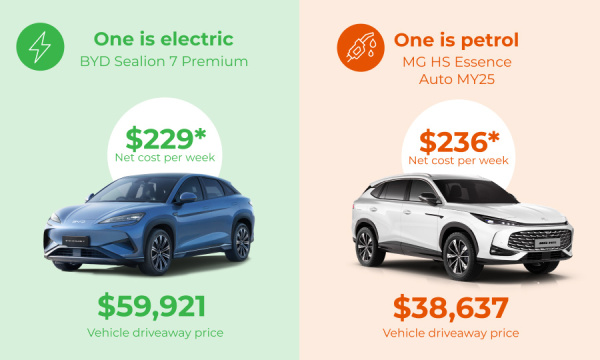

Here’s how the savings become really electrifying One is electric. One is petrol. Similar weekly cost.

Both based on an annual $90,000 salary, an annual distance of 15,000kms and a 5-year lease term

We'll do the heavy lifting

We can tap into our nationwide dealer network to source and potentially negotiate a great price on an EV, arrange all the paperwork and insurances.

Tax benefits

Payments on eligible EVs up to a cap of $91,387 are paid from your pre-tax salary when you enter into a novated lease.

Save on GST

You could save GST on your EV’s purchase price and some running costs.

Easy Budgeting

All your car repayments and regular running costs – that’s electricity, insurance, rego, maintenance and the like – can be bundled into one regular payroll deduction.

'The budgeting with a novated lease is so much easier.'

'To have a new car and cover all the costs in one regular payment is very helpful.'

'I don’t know why people wouldn’t do it; you’re going to have to buy a car anyway! I love everything about it. There’s nothing about it that I think, ‘I wish I had that’… I can even claim washing the car – it’s crazy!'

'There’s the tax incentives; no hassle in terms of car maintenance; convenience when it comes to expenses and budgeting for the yearly payments'

'This is my first ever new car. I’ve been driving borrowed and cheap bombs for years... To step into something that is so right for my lifestyle feels fantastic.'

A novated lease could be a great way to get into a great car. Basically, a car is leased in your name, via your employer, and all your repayments and running costs - including fuel, maintenance, insurance and registration - are bundled into regular, potentially tax-effective payroll deductions. For more information please check our website, or give us a call on 1300 123 123.

Once you’ve decided on your car (which we can also help with) we establish a simple annual budget that rolls all your car’s running costs – including finance, petrol, servicing, registration and insurance – into one regular payment using a combination of your pre- and post-tax salary.

This means potential tax savings, no more juggling bills and due dates, and you don’t pay GST on the purchase price of a new car, either!

Yes, you can salary package electricity costs within your EV lease. You must be able to demonstrate specifically how much energy – and the cost of the energy – is going towards charging your EV. This can be either obtained through a separate smart meter installed in your home, or by purchasing a fast, in-home charger with the metering included within it.

A novated lease bundles all of your car repayments and budgeted running costs into one regular payment directly from your pay.

You can use a mixture of post- and pre-tax funds to help pay for your fuel, tyres, insurance, registration, maintenance and even car detailing. By packaging these expenses under a novated lease, you could save on tax.

**$5,000 BMW Bonus Offer

Offer applies to eligible new and demonstrator BMW iX1, iX2 and i4 eDrive35 vehicles made available through novated lease arrangements, where the vehicle is sourced via BMW’s authorised dealer network between 1 March 2025 and 30 June 2025, and delivered by 30 June 2025. The $5,000 bonus is provided by BMW and has been factored into the advertised drive-away price. To be eligible, vehicles must be ordered by 6 June 2025 to allow sufficient time for delivery by 30 June 2025. Offer available through a novated lease administered by Maxxia and subject to credit approval and employer participation.

*All eligible vehicles must be ordered before 06/06/2025 (unless extended), or while stocks last. Displayed price is only available through a novated lease administered by Maxxia. Weekly costs have been determined based on the following assumptions: 1) The lease is a Maxxia fully maintained lease, 2) a 5 year term, 3) a residual value of 28.13% of the vehicle purchase price payable at the end of term, 4) Inclusion of finance and budgeted costs for: fuel or electricity, 8 replacement tyres, maintenance, roadside assistance, registration, CTP and comprehensive insurance, 5) Gross annual salary is $90,000 6) Vehicle purchased in NSW, 7) 15,000km per annum, 8) Salary Sacrifice using Employee Contribution Method (ECM) or Fringe Benefits Tax Exempt Method. The Fringe Benefits Tax Exempt Method is only used for eligible electric vehicles under the luxury car tax threshold of $91,387. The indicative price quoted for the novated lease is based on vehicle quotations Maxxia has received within the last 45 days and does not include any optional extras. Any optional extras that you choose will affect the cost of the novated lease and residual value. If you purchase the vehicle on termination of the novated lease, GST will apply on the purchase price you pay at that time. The novated lease offer is based on the assumption outlined above, and is an indicative cost approximation of the selected vehicle and model shown and the amounts may change at the time the novated lease quotation is completed and finalised. Your individual circumstances have not been taken into account as this will affect the overall weekly cost amount and the benefits of a novated lease. These specials cannot be used in conjunction with any other offer.

From 1 April 2025, a plug-in hybrid electric vehicle is no longer considered a zero or low emissions vehicle under FBT law. However, your employer can continue to apply the exemption if both the following requirements are met: 1) Use of the plug-in hybrid electric vehicle was exempt before 1 April 2025. 2) You have a financially binding commitment to continue using the vehicle for private use on and after 1 April 2025. For this purpose, any optional extension of the agreement is not considered binding. To qualify for the EV discount, plug-in hybrid electric vehicles must have been delivered by midnight on 31 March 2025.

^Savings shown are indicative and reflect estimated tax savings over the full-term of the lease. The total amount saved is a comparison between a novated lease based on the assumption outlined above and the purchase of a vehicle and payment of running and maintenance costs using post-tax earnings. Actual savings will depend on your personal circumstances.

^Novated Lease example: The estimated potential tax benefit is over the full-term of the lease, is exclusive of GST and is based on the assumption that you would salary package using Employee Contribution Method (ECM) or Fringe Benefits Tax Exempt Method. The Fringe Benefits Tax Exempt Method is only used for eligible electric vehicles under the luxury car tax threshold of $91,387. Payment includes: Your car payments, fuel or charging, registration, tyres, insurance, scheduled servicing, fleet management fee and are exclusive of GST. The estimated annual benefit will vary depending upon salary, employment circumstances, selected benefits and applicable tax treatment. The example assumes you earn $90,000 a year, a 5-year lease term, an annual distance travelled of 15,000kms and a 28.13% residual value. GST of 1/11th is payable on your ECM contributions. State Stamp Duty rates apply. PAYG tax rates effective 1 July 2024 have been used.

#Please note that stock levels vary from time-to-time and so certain vehicles may not be available at the time of enquiry.

Things you need to know: This general information doesn't take your personal circumstances into account. Please consider whether this information is right for you before making a decision and seek professional independent tax or financial advice. Conditions and fees apply, and you should consider if they are acceptable before you accept any arrangements with Maxxia, along with credit assessment criteria for lease and loan products. The availability of benefits is subject to your employer’s approval. Maxxia may pay and/or receive commissions in connection with its services. Actual vehicle prices are based on specific vehicle and accessories, prices and savings may vary based on additional options selected with vehicle. Maxxia does not act as your agent or representative in respect of the purchase of any vehicle. Maxxia does not provide any advice or recommendations in relation to the purchase of any vehicle. Maxxia Pty Ltd | ABN 39 082 449 036

Please note: The content of this page is provided to you on the condition that you undertake all enquiries and have the responsibility for assessing the accuracy of the content and if any of the offers are right for you. Maxxia gives no guarantee and accepts no liability for the quality, safety or standard of motor vehicles or parts referred to or the truth or accuracy of the information contained on this page except to the extent required by law including, but not limited to, consumer guarantees under the Australian Consumer Law. You acknowledge that any images shown on this page are for illustration purposes only and may not be an exact representation of the motor vehicle on offer. The specifications you choose may affect the price you pay.

Whether you’re ready to get started or would like to know more, we’re here to help.