Love to have access to more pay in your pocket each year? Without having to work for it? Great. Put your feet up and let’s talk salary packaging because it could be your easy way of taking home hundreds, if not thousands more in tax savings each year.

Even better, salary packaging requires little to no work from you once it is set up. We take care of it with your employer while you relax. It’s simple to pay your regular expenses, and could make a real difference to your cost of living, which may come in very handy, right now.

How salary packaging makes ever dollar count

We know it sounds complicated but, simply put, salary packaging allows you to access some of your salary before tax is taken out. It means you could pay less income tax and therefore have more money in your pocket each year. And, it’s 100% ATO approved.

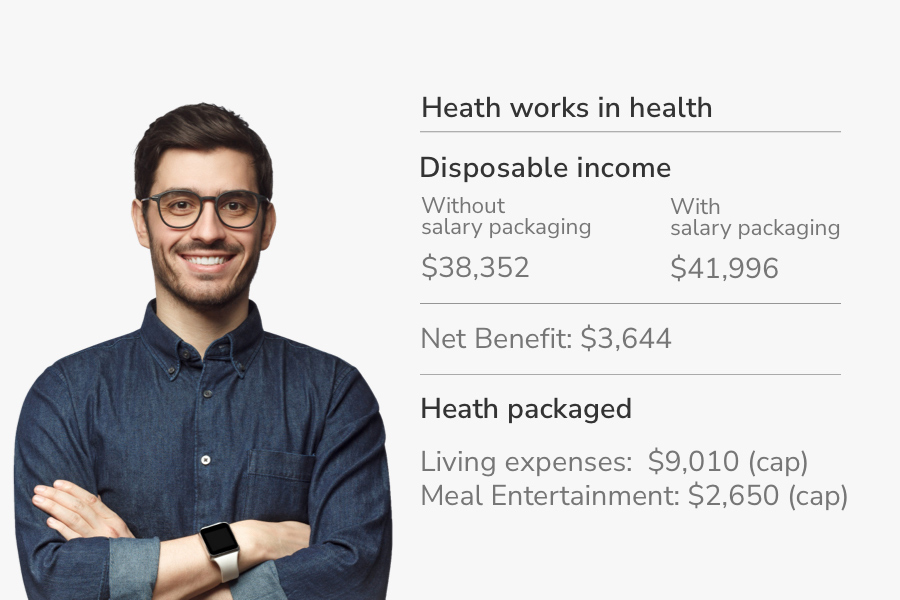

Salary packaging for Health Employees

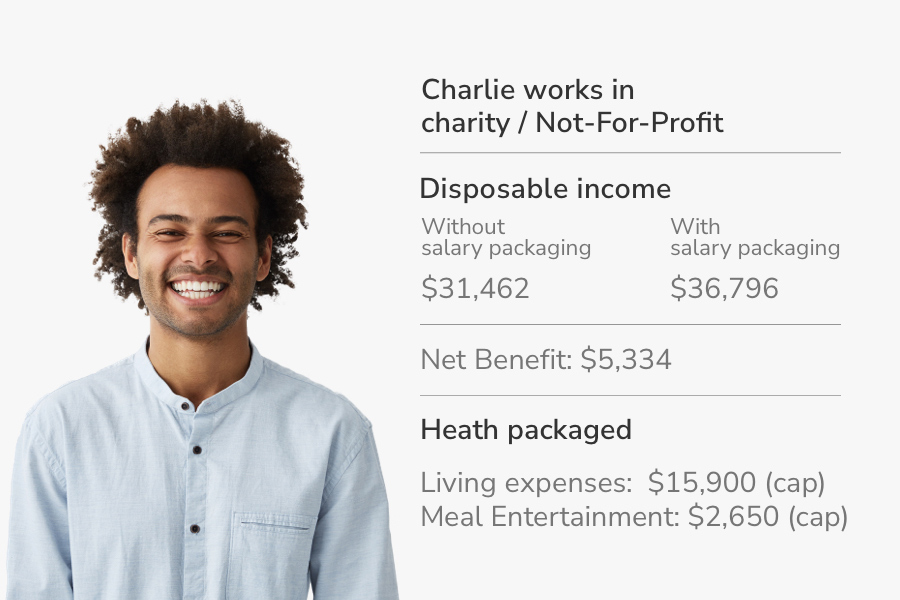

Salary Packaging for Not-for-Profit Employees

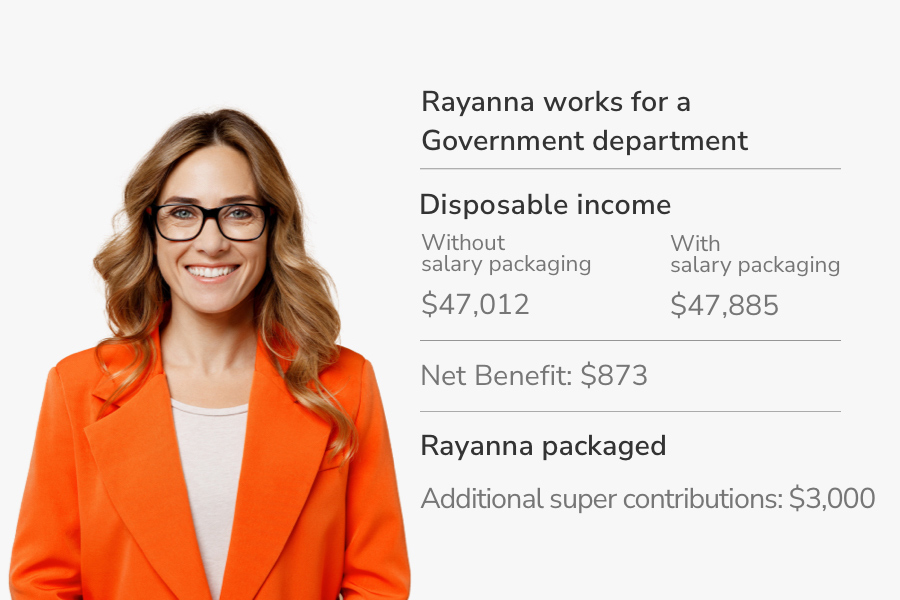

Salary packaging for Corporate Employees

Help with HECS-HELP debt

The great news is not only can you still salary package when you have a HECS-HELP debt but you could take home more money each year and be paying down your debt faster.

All you need to do is ask your payroll department to deduct additional HECS-HELP repayments. Maxxia can help you work out how much with our HECS-HELP calculator.

Maximise your savings from minimal change

Ready to salary package? We set it all up with your employer, so you don’t do much at all. It’s maximum pay for minimum effort

FAQs

How will my HECS-HELP debt impact my salary packaging?

If you have a HELP debt, you may need to adjust your HELP repayments when you salary package. This is because your HELP repayments are calculated based on your ‘HELP Repayment Income’ (HRI). In most cases, this will be your annual taxable income plus your total reportable fringe benefits amount shown on your PAYG Payment Summary.

Understanding your 'adjusted taxable income'

Although salary packaging can reduce your taxable income, it can increase the gross value of your salary. This is referred to as your 'adjusted taxable income'.

How your adjusted taxable income impacts HECS-HELP repayments

The ATO assesses you on your 'adjusted taxable income' when working out how much you should pay in HELP or HECS repayments.

Your adjusted taxable income equals your salary plus the gross value of your fringe benefits (e.g. $40,900 + $17,000 = $57,900).

Before you start...

Before you start salary packaging, please tell your payroll department to take additional HELP or HECS repayments from your salary.

You should seek financial advice if you're unsure.

How do I claim?

Three ways to claim your salary packaging benefits:

1. Set up automatic payments where possible

The easiest way to claim benefits is to set up automatic payments for items such as mortgage, rent or personal loan payments. This allows us to take care of it all for you. And you avoid any extra paperwork.

Once you've provided initial documentation to verify the expense (e.g. home loan records), your job is done.

2. Through the Maxxia Wallet

The Maxxia Wallet is a technology-loaded smart card that makes claiming everyday living expenses, such as fuel and groceries, fast and easy.

You use it like a credit card – except the funds are drawn from your salary packaging account. Just swipe, sign or PIN, and go. To find out more go to maxxia wallet.

3. How to submit a claim online

If you don't have a Maxxia Wallet - or if you've already paid for the item - you can submit a claim for reimbursement.

Maxxia app is another easy way to make a claim, anywhere, anytime, from an Apple or Android mobile device, such as smart phones and tablets. With built in camera functionality, all you need to do is click, claim and go!

With Maxxia Online and the app, you can submit a claim for reimbursement or set up a payment direct to a supplier. For payments you've already made, we will reimburse the money into your nominated bank account, generally within 2-3 business days - it's that easy!

Alternatively, you can mail to: Maxxia, Locked Bag 18, Collins Street East, Melbourne, Victoria 3000

Once received, we'll process your claim within 2-3 business days and deposit the funds from your salary packaging account into your regular bank account.

We will also send you a confirmation email on the same day.

Important Information: The information about the Maxxia Wallet is general in nature and does not take into account your personal objectives, needs and circumstances. You should consider the appropriateness of the information having regard to your personal circumstances and consider the Product Disclosure Statement before making any decision.

I don’t work full-time – am I still eligible?

No matter how many hours you work or your employment status – full-time, part-time or casual – if you’re paying income tax and your employer offers salary packaging, you could be eligible.

A point to note though: Employees earning less than the tax-free threshold of $18,200 may not have to pay income tax. How much you could save through salary packaging could be impacted if you earn less than, or just above the tax-free threshold. We recommend you seek independent financial or taxation advice before proceeding with salary packaging.

*Salary Packaging:

Heath: The estimated potential tax benefit is based on the assumption that an eligible employee with an annual salary of $60,000 salary packages to a $9,010 per annum limit and claims $2,650 in venue hire and meal and entertainment expenses. FBT rates effective 1 April 2024 and PAYG tax effective 1 July 2024 have been used and average Fees and Charges are included. The actual administration fee that applies to you may vary depending on your employer. Tax, benefit and Medicare Levy calculations are approximate, and assume no other taxable income is received. HELP repayments and taxation surcharges are excluded.

Charlie: The estimated potential tax benefit is based on the assumption that an eligible employee with an annual salary of $60,000 salary packages to a $15,900 per annum limit and claims $2,650 in venue hire and meal and entertainment expenses. FBT rates effective 1 April 2024 and PAYG tax effective 1 July 2024 have been used and average Fees and Charges are included. The actual administration fee that applies to you may vary depending on your employer. Tax, benefit and Medicare Levy calculations are approximate, and assume no other taxable income is received. HELP repayments and taxation surcharges are excluded

Rayanna: The estimated potential tax benefit is based on the assumption that an eligible employee with an annual salary of $60,000 salary packages to a $3,000 per annum limit.FBT rates effective 1 April 2024 and PAYG tax effective 1 July 2024 have been used and average Fees and Charges are included. The actual administration fee that applies to you may vary depending on your employer. Tax, benefit and Medicare Levy calculations are approximate, and assume no other taxable income is received. HELP repayments and taxation surcharges are excluded

1Additional superannuation contributions from pre-tax salary are subject to 15% contributions tax. The taxation of additional superannuation contributions via salary packaging may differ from the taxation of additional superannuation contributions from post-tax salary. Additional superannuation contributions will be reported on an employee’s annual payment summary and will be used to assess an employee’s eligibility for a number of government benefits, or liability for certain payments. Caps for concessional superannuation contributions apply – please refer to www.ato.gov.au for up to date information. Only one laptop and one iPad or tablet can be salary packaged per FBT year and must be used primarily for business purposes.

The Meal Entertainment benefit has a maximum annual cap limit of $2,650. This will appear as a reportable fringe benefit on your Payment Summary each year which will be included in a number of income tests relating to certain government benefits and obligations. This cap is separate from the FBT cap limits for everyday living expenses. The Meal Entertainment benefit does not cover take-away meals, groceries or eating out on your own.

Important Information: This general information doesn’t take your personal circumstances into account. Please consider whether this information is right for you before making a decision and seek professional independent tax or financial advice. Conditions and fees apply, and you should consider if they are acceptable before you accept any arrangements with Maxxia, along with credit assessment criteria for lease and load products. The availability of benefits is subject to your employer’s approval. Maxxia may pay and/or receive commissions in connection with its services.

Maxxia Pty Ltd | ABN 39 082 449 036