Get behind the wheel of an FBT-exempt electric vehicle

The Electric Car Discount could help you save on tax through a novated lease.

How much you could save on an EV novated lease

We'll do the heavy lifting

We can tap into our nationwide dealer network to source and potentially negotiate a great price on an EV, arrange all the paperwork and insurances.

Tax benefits

Payments on eligible EVs up to a cap of $91,387 are paid from your pre-tax salary when you enter into a novated lease.

Save on GST

You could save GST on your car’s purchase price and some running costs.

Easy Budgeting

All your car repayments and regular running costs – that’s electricity, insurance, rego, maintenance and the like – can be bundled into one regular payroll deduction.

A government discount for driving an EV? Yes please!

With the Australian Government’s Electric Car (EV) Discount, taking out a novated lease on an EV just got a whole lot cheaper. Novated leases are required by law to have a certain amount of Fringe Benefits Tax (FBT) be paid – it’s why pre- and post-tax payments are needed. With the Electric Car Discount however, a novated lease on an eligible EV is FBT exempt, meaning you don’t pay any post-tax contributions – for EVs retailing up to the Luxury Car Tax threshold of $91,387#.

How Much Could You Save on an EV Novated Lease?

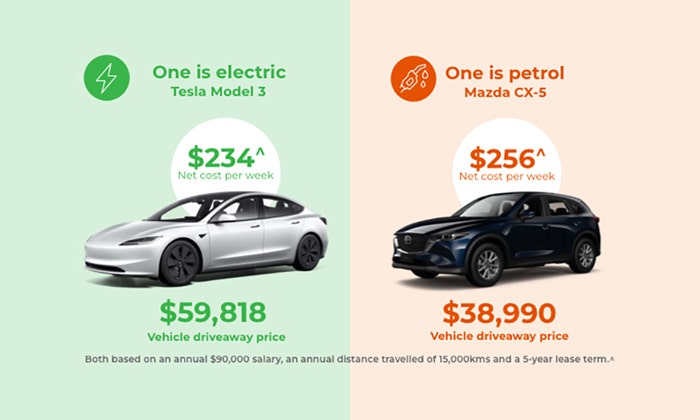

Electric Vehicles are currently more expensive than their petrol counterparts. However, with the Federal Government Electric Car (EV) Discount and novated leasing, you could pay around the same amount for a new electric car as an equivalent petrol car – potentially saving you thousands of dollars.

In this example, the Tesla 3’s driveaway price is over $20,000 more than the Mazda CX-5, yet the cost per week is comparable.

What is novated leasing and how does it work?

Put simply, a novated lease is a smart way to get into a new or used car. A three-way salary packaging agreement between you, your employer and a financier, it’s convenient and hassle-free.

Convenience. Potential tax savings. Better budgeting. A great deal.

It could also be tax-effective. Because your repayments are made partly from your before-tax salary, you could lower your taxable income and pay less income tax. These benefits can apply regardless of your employment status or income level, or whether you drive a little or a lot.

Maxxia has been one of Australia’s leading novated leasing providers for almost 30 years now, and we’ve gained plenty of mates along the way. What that means is access to some of the best deals and manufacturers across the country.

Have a car in mind?

Find out what Maxxia can do for you by simply completing our form. We’ll call you at a convenient time to discuss your needs, and answer any queries you might have. Kick back and relax while we help you get a great deal on a great car.

Frequently Asked Questions

Novated leasing: the whys and hows

Cars can be expensive – and a bother to keep track of when it comes to costs and upkeep. By salary packaging a car through Maxxia, you can soften the hip-pocket pain and remove much of the hassle.

Once you’ve decided on your car (which we can also help with) we establish a simple annual budget that rolls all your car’s running costs – including finance, petrol, servicing, registration and insurance – into one regular payment using a combination of your pre- and post-tax salary.

This means potential tax savings, no more juggling bills and due dates, and you don’t pay GST on the purchase price of a new car, either!

Hold the GST

That’s right – when you source a new car through Maxxia you not only get access to our nationwide buying power, meaning competitive prices on an extensive range of new cars, but you don't pay GST on the purchase price. Our nationwide buying power gives us access to lots of great cars – and great deals.

Potential tax savings

Because part of your car payments come from your pre-tax salary, your taxable income could be less. (Once your deductions commence, your payslip will show the pre- and post-tax deductions made to Maxxia relating to your novated lease.) With a regular car loan, you’d be making payments with your post-tax salary – and giving more to the taxman.

Access to competitive third-party pricing

As one of Australia’s leading novated lease providers, we have long-held relationships with suppliers and insurers nationwide, and can help you get competitive prices. No more worries about insurance coverage and over-charging mechanics.

Roll up, roll up

Cruising along an open road in your new car aside, it’s the convenience of a novated lease that many enjoy. In addition to your car repayment, all of those dreaded running costs – fuel, servicing, insurance and, most pertinently, registration – are rolled up into one regular payroll deduction. And the cherry on top? You could save on tax!

*All eligible vehicles must be ordered before 30/06/2025 (unless extended), or while stocks last. Displayed price is only available through a novated lease administered by Maxxia. Weekly costs have been determined based on the following assumptions: 1) The lease is a Maxxia fully maintained lease, 2) a 5 year term, 3) a residual value of 28.13% of the vehicle purchase price payable at the end of term, 4) Inclusion of finance and budgeted costs for: fuel or electricity, 8 replacement tyres, maintenance, roadside assistance, registration, CTP and comprehensive insurance, 5) Gross annual salary is $90,000 6) Vehicle purchased in NSW, 7) 15,000km per annum, 8) Salary Sacrifice using Employee Contribution Method (ECM) or Fringe Benefits Tax Exempt Method. The Fringe Benefits Tax Exempt Method is only used for eligible electric vehicles under the luxury car tax threshold of $91,387. The indicative price quoted for the novated lease is based on vehicle quotations Maxxia has received within the last 45 days and does not include any optional extras. Any optional extras that you choose will affect the cost of the novated lease and residual value. If you purchase the vehicle on termination of the novated lease, GST will apply on the purchase price you pay at that time. The novated lease offer is based on the assumption outlined above, and is an indicative cost approximation of the selected vehicle and model shown and the amounts may change at the time the novated lease quotation is completed and finalised. Your individual circumstances have not been taken into account as this will affect the overall weekly cost amount and the benefits of a novated lease. These specials cannot be used in conjunction with any other offer.

#For the 2024/25 financial year.

^Savings shown are indicative and reflect estimated tax savings over the full-term of the lease. The total amount saved is a comparison between a novated lease based on the assumption outlined above and the purchase of a vehicle and payment of running and maintenance costs using post-tax earnings. Actual savings will depend on your personal circumstances.

^Novated Lease example: The estimated potential tax benefit is over the full-term of the lease, is exclusive of GST and is based on the assumption that you would salary package using Employee Contribution Method (ECM) or Fringe Benefits Tax Exempt Method. The Fringe Benefits Tax Exempt Method is only used for eligible electric vehicles under the luxury car tax threshold of $91,387. Payment includes: Your car payments, fuel or charging, registration, tyres, insurance, scheduled servicing, fleet management fee and are exclusive of GST. The estimated annual benefit will vary depending upon salary, employment circumstances, selected benefits and applicable tax treatment. The example assumes you earn $90,000 a year, a 5-year lease term, an annual distance travelled of 15,000kms and a 28.13% residual value. GST of 1/11th is payable on your ECM contributions. State Stamp Duty rates apply. PAYG tax rates effective 1 July 2024 have been used.

Things you need to know: This general information doesn't take your personal circumstances into account. Please consider whether this information is right for you before making a decision and seek professional independent tax or financial advice. Conditions and fees apply, along with credit assessment criteria for lease and loan products. The availability of benefits is subject to your employer’s approval. Maxxia may receive commissions in connection with its services.

Talk to us today about Salary Packaging the Maxxia way

Whether you’re ready to get started or would like to know more, we’re here to help.