How much could I save with salary packaging if I have a HECS-HELP debt?

Health

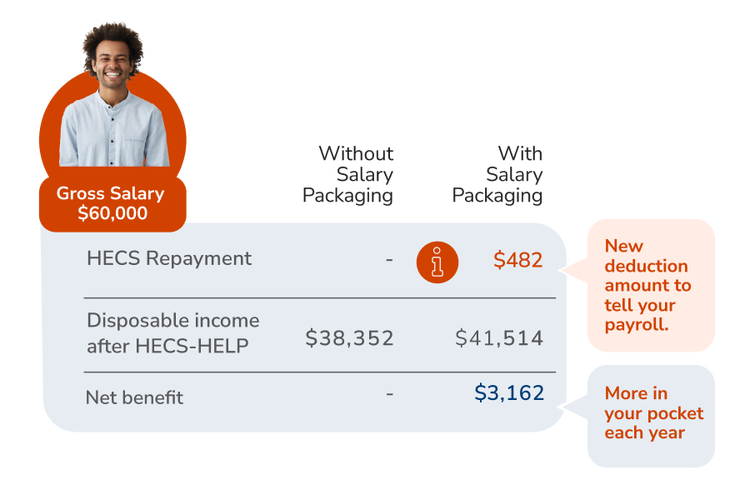

Let’s say you’re a health worker with a HECS-HELP debt earning $60,000. By packaging your full living expenses benefit of $9,010, as well as Meal Entertainment benefit of $2,650, you could be almost $3,162 better off each year!*

While your HECS-HELP repayments increase as they are calculated on this adjusted income, you could still increase your disposable income each year through reduced tax.

Charity

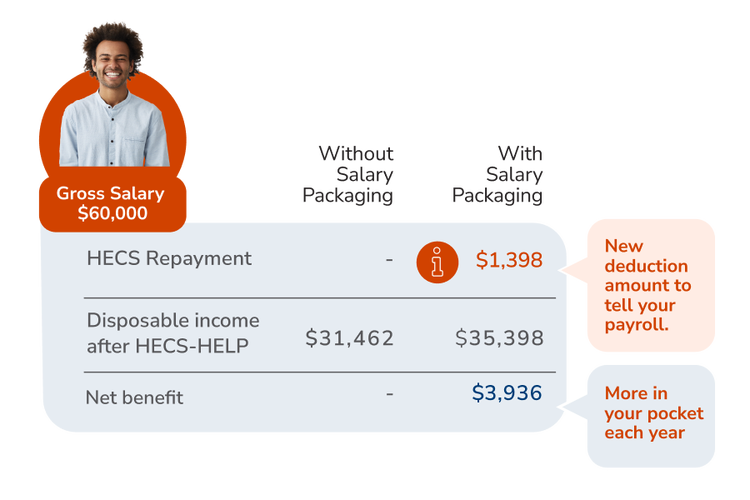

Let's say you work for a not-for-profit organisation earning $60,000. By packaging your full living expenses benefit of $15,900, as well as Meal Entertainment benefit of $2,650, you could be almost $3,936 better off each year!^

While your HECS-HELP repayments increase as they are calculated on this adjusted income, you could still increase your disposable income each year through reduced tax.

Health

*Salary Packaging: The estimated potential tax benefit is based on an eligible employee with an annual salary of $60,000, salary packaging the full $9,010 per annum limit and claiming $2,650 in venue hire and meal entertainment expenses. PAYG tax rates effective 1 July 2024 have been used. HELP repayments are based on 2025-2026 HELP repayment thresholds and rates. An average salary packaging administration fee has been used. The actual administration fee that applies to you may vary depending on your employer. Estimated annual benefit based on the assumption that an employee does not have any accumulated Financial Supplement debt. Your disposable income will vary based on your income and personal circumstances. Compulsory HELP repayments commence once your adjusted taxable income is above $67,000.

Charity

^Salary Packaging: The estimated potential tax benefit is based on an eligible employee with an annual salary of $60,000, salary packaging the full $15,900 per annum limit and claiming $2,650 in venue hire and meal entertainment expenses. PAYG tax rates effective 1 July 2024 have been used. HELP repayments are based on 2025-2026 HELP repayment thresholds and rates. An average salary packaging administration fee has been used. The actual administration fee that applies to you may vary depending on your employer. Estimated annual benefit based on the assumption that an employee does not have any accumulated Financial Supplement debt. Your disposable income will vary based on your income and personal circumstances. Compulsory HELP repayments commence once your adjusted taxable income is above $67,000.